Vancouver, B.C. (December 20, 2023) – Canterra Minerals Corporation (TSXV:CTM) (OTCQB: CTMCF) (“Canterra” or the “Company”) is pleased to announce, further to its news release issued on November 22, 2023, that it has completed the previously announced acquisition of five critical and precious metals projects in central Newfoundland (the “Properties”), adding 316 km2 to Canterra’s property position. The acquisition was completed with Buchans Resources Limited (“BRL”), an arms-length non-listed Reporting Issuer, and its subsidiary Buchans Minerals Corporation.

In addition, the Company has closed its oversubscribed, previously announced non-brokered private placement financing (the “Offering”) (see news releases dated November 29, 2023, December 12, 2023 and December 18, 2023) for gross proceeds of $1,538,598.95.

Canterra’s total property position in the central Newfoundland critical minerals and gold belts is now approximately 684 km2, allowing for expansion of exploration efforts across these highly prospective districts. The Company will begin targeting work on the properties immediately with drilling scheduled on its Lemarchant Project anticipated in the first quarter of 2024.

Acquisition Highlights:

- Creates a district scale portfolio consisting of 7 resource stage critical minerals projects

- Consolidated indicated mineral resource of 1.4 billion pounds contained zinc and inferred mineral resource of 317 million pounds contained zinc(1)(2)(3)(4)(5)(6)(7)

- Consolidated indicated mineral resource includes 251 million pounds of contained copper and significant gold and silver credits(1)(2)(3)(4)(5)(6)(7)

- Adds a large bulk tonnage mineral resource at the Buchans Mine (Lundberg deposit) (4) with substantial opportunity for new high-grade Zn-Cu VMS discoveries within the brownfields site

- Synergistic acquisition that consolidates critical and precious metals properties (total size of 684 km2) in the Buchans Camp, Victoria Lake Camp and Valentine Lake Shear Zone

- Canterra emerges with two drill ready projects both with prospective advanced stage high-grade Cu-Zn massive sulfide targets

- Addition of Michael Power, currently a director of BRL, as Director of Canterra, an Engineer and Chartered Financial Analyst with over 50 years of experience in the mining industry

- Canterra bolsters its exploration team with the addition of Paul Moore as VP Exploration and David Butler as Exploration Manager, each currently holding those roles at BRL, who combined have 60 years of experience in Eastern Canada

Mineral Resource Estimates at the Properties

The Properties host significant polymetallic mineral resource estimates completed by previous operators over various effective dates. All mineral resource estimates have considerable opportunity for expansion.

Table 1 - Mineral Resource Estimates (see notes below for effective dates)

|

Deposit |

Category |

Tonnes |

Zn (%) |

Cu (%) |

Pb (%) |

Au (g/t) |

Ag (g/t) |

|

Lundberg |

Indicated |

16,790,000 |

1.5 |

0.4 |

0.6 |

0.07 |

5.7 |

|

Inferred |

380,000 |

2.0 |

0.4 |

1.0 |

0.31 |

22.4 |

|

|

Bobby’s Pond |

Indicated |

1,100,000 |

4.6 |

0.9 |

0.4 |

0.20 |

16.6 |

|

Inferred |

1,200,000 |

3.8 |

1.0 |

0.3 |

0.06 |

11.0 |

|

|

Daniel’s Pond |

Indicated |

929,000 |

5.1 |

0.3 |

2.5 |

0.60 |

101.4 |

|

Inferred |

332,000 |

4.6 |

0.3 |

2.1 |

0.53 |

85.9 |

|

|

Tulks Hill |

Inferred |

430,200 |

4.0 |

0.9 |

1.6 |

1.20 |

35.1 |

|

Contained |

Zn (M lbs) |

Cu (M lbs) |

Pb (M lbs) |

Au (K oz) |

Ag (M oz) |

||

|

Total Indicated |

821 |

192 |

313 |

72 |

6.5 |

||

|

Total Inferred |

151 |

32 |

32 |

11 |

1.5 |

||

Notes:

Mineral resources are not mineral reserves and do not have demonstrated economic viability. Figures rounded to reflect relative accuracy of the estimates.

Lundberg Mineral Resource Estimate is based on $20 US/t NSR cutoff from the technical report entitled “NI 43-101 Technical Report and Mineral Resource Estimate on the Lundberg Deposit, Buchans Area, Newfoundland and Labrador, Canada”, and dated April 15, 2019, was prepared by: Michael Cullen P. Geo., Matthew Harrington, P. Geo., and Shaun O’Connor, P. Geo. Figures have been rounded to reflect the relative accuracy of the estimates.

Bobby’s Pond Mineral Resource Estimate is based on a 1.0% CuEq cutoff from the technical report entitled “Technical report on the Bobby's Pond CU-Zn deposit, Newfoundland and Labrador, Canada” prepared for Mountain Lake Resources Inc., report date: July 31, 2008, as prepared by RPA.

The Daniel’s Pond resource estimate is Based on a 2% Zn cutoff from the technical report entitled “Revised Technical Report on the Daniels Pond Deposit and Property Holdings of Royal Roads Corp. Red Indian Lake Area, Newfoundland, Canada” prepared for Royal Roads Corp., Effective Date: April 29th, 2008, as prepared by Peter C. Webster, B.Sc., P.Geo., P. James F. Barr, B.Sc., and Rafael Cavalcanti de Albuquerque, B.Sc. of Mercator Geological Services.

The Tulks Hill resource estimate is Based on a 1.1% Cu Equivalent cutoff grade the technical report entitled “Technical Report on the Tulks Hill Cu-Zn Project, Newfoundland and Labrador, Canada” prepared for the Tulks Hill Joint Venture between Prominex Resources Corp. (Operator) and Buchans River Limited as prepared Hryar Agnerian M.Sc. P.Geo. of Scott Wilson Roscoe Postle Associates Inc. All figures have been rounded to reflect the relative accuracy of the estimates.

Chris Pennimpede, CEO & President of Canterra, commented “Canterra aims to uncover mineral deposits in central Newfoundland. These assets strengthen land position within the central Newfoundland mining corridor, opening avenues for substantial discoveries within the belt. Our existing properties near the Teck’s past producing Duck Pond Mine already has compelling VMS deposits and exploration prospects, complementing our established orogenic gold deposit opportunities. Echoing the industry adage that the best place to look for a mine is in the shadow of a headframe, Canterra will now be exploring at the brownfields site of the prolific Buchans Mine. The Buchans Project is ripe for a modern approach with significant exploration potential for high grade VMS mineralization. With a 684 km2 land position encompassing mineral rights across existing deposits, we anticipate being strongly positioned to unveil the next mineral discovery in central Newfoundland.”

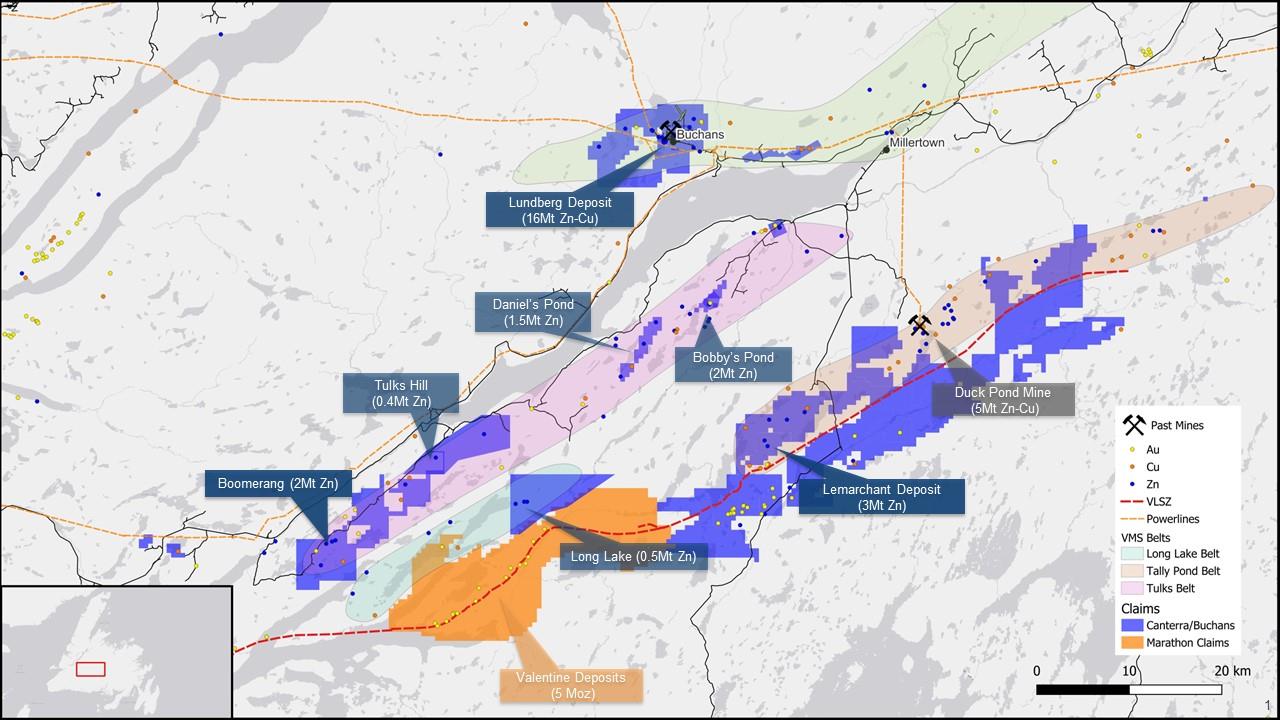

The principal properties to be acquired are the Buchans Mine Property (hosting the Lundberg deposit), the Bobby’s Pond Property (hosting the Bobby’s Pond deposit), the Tulks Hill Property (hosting the Tulks Hill deposit), and the Daniel’s Pond Property (hosting the Daniel’s Pond deposit). The location of the properties is shown in Figure 1.

Figure 1 -Canterra Land position in Central Newfoundland

Buchans Mine Property

The Buchans Mine Property encompasses 82.5 km2 of mineral claims and mining leases and is located adjacent to the town of Buchans. This property contains the past-producing Buchans Mine that was operated by ASARCO between 1928 and 1984 and is underlain by the volcano-sedimentary Buchans Group. The property also contains the Lundberg deposit, a VMS stockwork deposit that comprises a large, near-surface resource of stockwork sulphide mineralization. Lundberg’s mineralization is located immediately beneath workings of the previously mined, high-grade Lucky Strike massive sulphide orebody from which ASARCO mined 5.6 million tonnes of ore averaging 18.4% Zn, 8.6% Pb, 1.6% Cu, 112 g/t Ag & 1.7 g/t Au, essentially pre-stripping a large portion of the Lundberg resource.

The total ore mined over the life of the historic Buchans Mine is estimated to be 16 million tonnes at an average grade of 14.5% Zn, 7.6% Pb, 1.3% Cu, 1.37 g/t Au & 126 g/t Ag(4). The current Lundberg deposit resource estimate is shown in Table 2.

Table 2: Lundberg Deposit Pit Constrained Mineral Resource Estimate (effective March 1, 2019)

|

Category |

Tonnes |

Zn (%) |

Cu (%) |

Pb (%) |

Ag (g/t) |

Au (g/t) |

ZnEq (%) |

|

Indicated |

16,790,000 |

1.53 |

0.42 |

0.64 |

5.7 |

0.07 |

4.46 |

|

Inferred |

380,000 |

2.03 |

0.36 |

1.01 |

22.4 |

0.31 |

5.49 |

Notes:

Based on $20 US/t NSR cutoff from the technical report entitled “NI 43-101 Technical Report and Mineral Resource Estimate on the Lundberg Deposit, Buchans Area, Newfoundland and Labrador, Canada”, and dated April 15, 2019, was prepared by: Michael Cullen P. Geo., Matthew Harrington, P. Geo., and Shaun O’Connor, P. Geo. Figures have been rounded to reflect the relative accuracy of the estimates.

Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The Buchans Mine Property lies on the north side of Beothuk Lake 35 km from Teck Resources’ past producing Duck Pond Mine and Canterra’s Lemarchant VMS deposit. This project has benefited from substantial relogging and digitization of over 70 years of paper data and hundreds of thousands of metres of core relogging. In addition, a recent collaboration agreement with Boliden AB, a global mining company, utilized 3D modelling of this data and reprocessing the vast existing geophysical database. This data identified several drill targets for new high-grade massive sulfide deposits outside of the existing resource base. No drilling has yet been done to test these compelling new targets.

2018 exploration drilling at the underexplored Two-Level target intersected significant results in drillhole H-18-3524:

- 1.8 m of 5.57% Zn, 0.76% Cu, 3.15% Pb, 90.5 g/t Ag & 0.37 g/t Au

- incl. 1.0 m of 8.70% Zn, 1.26% Cu, 4.87% Pb, 133.2 g/t Ag & 0.47 g/t Au

The success of drilling at Two-Level target confirms recent modelling and demonstrates the potential to discover both new high-grade in situ VMS mineralization and transported VMS mineralization that comprised 52% of the previous mining. The Two-Level mineralization also represents an opportunity to add higher grade resources to expand the adjacent Lundberg deposit.

Terms of the Asset Purchase Agreement

The acquisition of the Properties (the “Acquisition”) was a cashless transaction, with the consideration comprising (a) 24,910,000 common shares (the “Consideration Shares”) of Canterra, representing an approximate 19.9% ownership interest at closing, and (b) 128,554,216 common share purchase warrants (the “Consideration Warrants”) of Canterra exchangeable for common shares of Canterra within two years of closing (subject to extension in certain circumstances), for no additional consideration, upon (a) the transfer of the Properties that are considered material to the Company; (b) the approval by the TSX Venture Exchange (the “TSXV”) and filing by the Company of an independent technical report on the historical Buchans mine and Lundberg deposit (the “Technical Report”); and (c) following subsequent actions of Buchans Minerals Corporation, the holder of the Consideration Warrants, and BRL, the distribution of up to all of the common shares to be received on exchange of the Consideration Warrants (the “Distributed Shares”) to the shareholders of BRL (the “BRL Shareholders”), provided that: (i) such exchange and distribution will not result in a Change of Control of the Company or the creation of a new Control Person of the Company; (ii) in respect of the Distributed Shares, BRL directs the Company to issue such Distributed Shares directly to BRL Shareholders and shall not be a holder of such Distributed Shares at any time; and (iii) in the event that such exchange and distribution results in the creation of a new Insider, the BRL Shareholder shall have filed and obtained clearance of a personal information form or declaration, as applicable, with the TSXV. For greater certainty, a BRL Shareholder (i) individually, (ii) in conjunction with any of its Affiliates or Associates, or (iii) acting jointly or in concert with any other shareholder of the Company will not result in a Change of Control of the Company, the creation of a new Control Person of the Company or the creation of a new Insider (without filing and clearing a personal information or declaration, as applicable). BRL may exchange some of the Consideration Warrants for common shares of Canterra that it would hold, provided that BRL will not thereby become a Control Person of the Company or effect a Change of Control of the Company. For these purposes, “Affiliate”, “Associate”, “Change of Control” “Control Person” and “Insider” are as defined by the policies of the TSXV.

The Consideration Shares and the Consideration Warrants (and underlying common shares of Canterra) will be subject to a statutory hold period, expiring four months and one day from the closing, being April 20, 2024. Additionally, they will be subject to transfer restrictions for a period of 24 months post-closing. The common shares of Canterra issuable upon exchange of the Consideration Warrants will be subject to contractual holds with 1/3 being freely tradable on distribution (assuming expiry of statutory hold), 1/3 being freely tradable on the date which is three months from distribution and 1/3 being freely tradable on the date which is six months from distribution.

Planned Technical Work on the Properties

The Company has provided an undertaking to the TSXV to file the Technical Report within 90 days of closing the Acquisition.

The Company anticipates expenditures on the Properties in 2024 will consist of holding costs (estimated to be $230,100), work requirements ($51,000), and a Phase 1 Exploration Expenditures on the Buchans Mine Property. The Phase 1 Exploration Expenditures on the Buchans Mine Property are expected to be primarily desktop in nature. Field work will be limited to survey work (geophysical) or rock sampling (geochemical). The Phase 1 Exploration Expenditures are estimated to be $100,000 and will focus on 3D modelling and drill targeting of all historical data at the Buchans Mine Property.

Financing Details

Pursuant to the Offering, Canterra issued 23,670,753 shares comprised of critical mineral exploration tax credit (“CMETC”) flow-through (“FT”) common shares at a price of $0.065 per FT share for aggregate proceeds of $1,538,598.95.

The gross proceeds of the Offering will be used to fund further exploration programs, including but not limited to drilling at the Boomerang and Lemarchant projects and expenditures on the Properties, which will qualify as "Canadian Exploration Expenses" and "flow-through critical mineral mining expenditures" as those terms are defined in the Income Tax Act (Canada), which will be renounced to the purchasers of the FT shares with an effective date no later than December 31, 2023.

The securities issued pursuant to the Offering are subject to a four month and one day statutory hold period in Canada, expiring on April 21, 2024.

In connection with the Offering, the Company paid finder’s fees of $80,459.94 in cash and 1,260,945 warrants to arm’s length persons. Each finder’s warrant is exercisable at $0.065 until December 20, 2025.

About Canterra Minerals

Canterra Minerals is a diversified minerals exploration company with a focus on critical minerals (zinc and copper) in central Newfoundland. Canterra’s critical metals projects include four deposits which host compliant resources with considerable exploration potential. The deposits are located in close proximity to Teck Resources’ past producing Duck Pond mine and the past producing Buchans Mine. The deposits host a combined complaint resource of 4.1 million tonnes of Indicated Resources and 1.2 million tonnes of Inferred Resources. See the NI 43-101 Technical Report “Lemarchant and South Tally Project, Technical Report and Updated Mineral Resource Estimate” effective September 20, 2018. In addition, Canterra holds exploration stage gold properties that cover 80 km of strike length of the regional gold bearing Rogerson Lake structural corridor which hosts Marathon Gold Corporation’s feasibility stage Valentine Lake Gold Project. The gold projects have been subject to four drilling campaigns, demonstrating many gold occurrences and warranting further exploration. In Alberta, Canada, Canterra also holds a 50% interest and is operator of the Buffalo Hills diamond project, with Star Diamond Corporation holding the remaining interest. The Buffalo Hills diamond project has been subject to considerable exploration expenditures, including a bulk sample, which has identified 38 kimberlites.

The scientific and technical information contained in this news release was reviewed and approved by Christopher Pennimpede, P.Geo., President & CEO of Canterra. Mr. Pennimpede is a Qualified Person as defined by NI 43-101.

ON BEHALF OF THE BOARD OF CANTERRA MINERALS CORPORATION

Chris Pennimpede

President & CEO

Additional information about the Company is available at www.canterraminerals.com

For further information, please contact: +1 (604) 687-6644

Email: info@canterraminerals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking InformationThis press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, including statements with respect to estimated mineral resources, the opening of avenues for substantial discoveries within the belt, the Buchans Project being ripe for a modern approach with significant exploration potential for high grade VMS mineralization, the Company anticipating being strongly positioned to unveil the next mineral discovery in central Newfoundland, the filing of the Technical Report, and the future exchange of the Consideration Warrants. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company’s business and prospects.; the business and operations of the Company; unprecedented market and economic risks associated with current unprecedented market and economic circumstances due to the COVID-19 pandemic, as well as those risks and uncertainties identified and reported in the Company's public filings under its SEDAR+ profile at www.sedarplus.ca. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

__________________________

(1) See NI-43-101 technical report entitled “NI 43-101 Technical Report and Updated Mineral Resource Estimate on the Lemarchant Deposit South Tally Pond Property, Central Newfoundland, Canada” prepared for NorZinc Ltd., Report Date: October 22, 2018, Effective Date: September 20, 2018, as prepared by Michael Cullen, P.Geo., Matthew Harrington, P.Geo. and Michael J. Vande Guchte, P.Geo. The report is available on the Company’s website at www.canterraminerals.com

(2) See NI-43-101 technical report entitled “Messina Minerals Inc.: Tulks South Property, Central Newfoundland, Canada Technical Report” prepared for Messina Minerals Inc., Report Date: August, 2007, as prepared by Snowden. The report is available on the Company’s website at www.canterraminerals.com

(3) See NI-43-101 technical report entitled “Independent Technical Report for the Main Zone of the Long Lake Volcanic Massive Sulphide Project, Newfoundland and Labrador, Canada” prepared for Messina Minerals Inc., Report Date: April 16, 2012, Effective Date: March 13, 2012, as prepared by SRK Consulting (Canada) Inc. The report is available on the Company’s website at www.canterraminerals.com

(4) Lundberg Mineral Resource Estimate is based on $20 US/t NSR cutoff from the technical report entitled “NI 43-101 Technical Report and Mineral Resource Estimate on the Lundberg Deposit, Buchans Area, Newfoundland and Labrador, Canada”, and dated April 15, 2019, was prepared by: Michael Cullen P. Geo., Matthew Harrington, P. Geo., and Shaun O’Connor, P. Geo. Figures have been rounded to reflect the relative accuracy of the estimates.

(5) Bobby’s Pond Mineral Resource Estimate is based on a 1.0% CuEq cutoff from the technical report entitled “Technical report on the Bobby’s Pond CU-ZN deposit, Newfoundland and Labrador, Canada” prepared for Mountain Lake Resources Inc., report date: July 31, 2008, as prepared by RPA. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

(6) The Daniel’s Pond resource estimate is Based on a 2% Zn cutoff from the technical report entitled “Revised Technical Report on the Daniels Pond Deposit and Property Holdings of Royal Roads Corp. Red Indian Lake Area, Newfoundland, Canada” prepared for Royal Roads Corp., Effective Date: April 29th, 2008, as prepared by Mercator Geological Services. All figures have been rounded to reflect the relative accuracy of the estimates.

(7) The Tulks Hill resource estimate is Based on a 1.1% Cu Equivalent cutoff grade the technical report entitled “Technical Report on the Tulks Hill Cu-Zn Project, Newfoundland and Labrador, Canada” prepared for the Tulks Hill Joint Venture between Prominex Resources Corp. (Operator) and Buchans River Limited as prepared by Hryar Agnerian of Scott Wilson Roscoe Postle Associates Inc. All figures have been rounded to reflect the relative accuracy of the estimates.